The Particular results that will seem are usually coming from businesses through which usually this web site may receive settlement, which usually might influence how, where in inclusion to inside exactly what order items seem. Not all firms, items or gives had been examined within reference to this listing. Fee-free OverdraftActual overdraft sum may possibly fluctuate plus is usually issue in buy to change at virtually any moment, at Current’s sole acumen. Unfavorable bills should end upward being repaid within 62 times regarding typically the very first Entitled Purchase that brought on the particular unfavorable equilibrium. For a great deal more information, please refer in buy to Fee-free Overdraft Phrases and Conditions . Immediate down payment and before supply associated with cash will be subject to timing of payer’s distribution of debris.

Carry Out I Want Primary Downpayment To Be Able To Meet The Criteria For A Funds Advance?

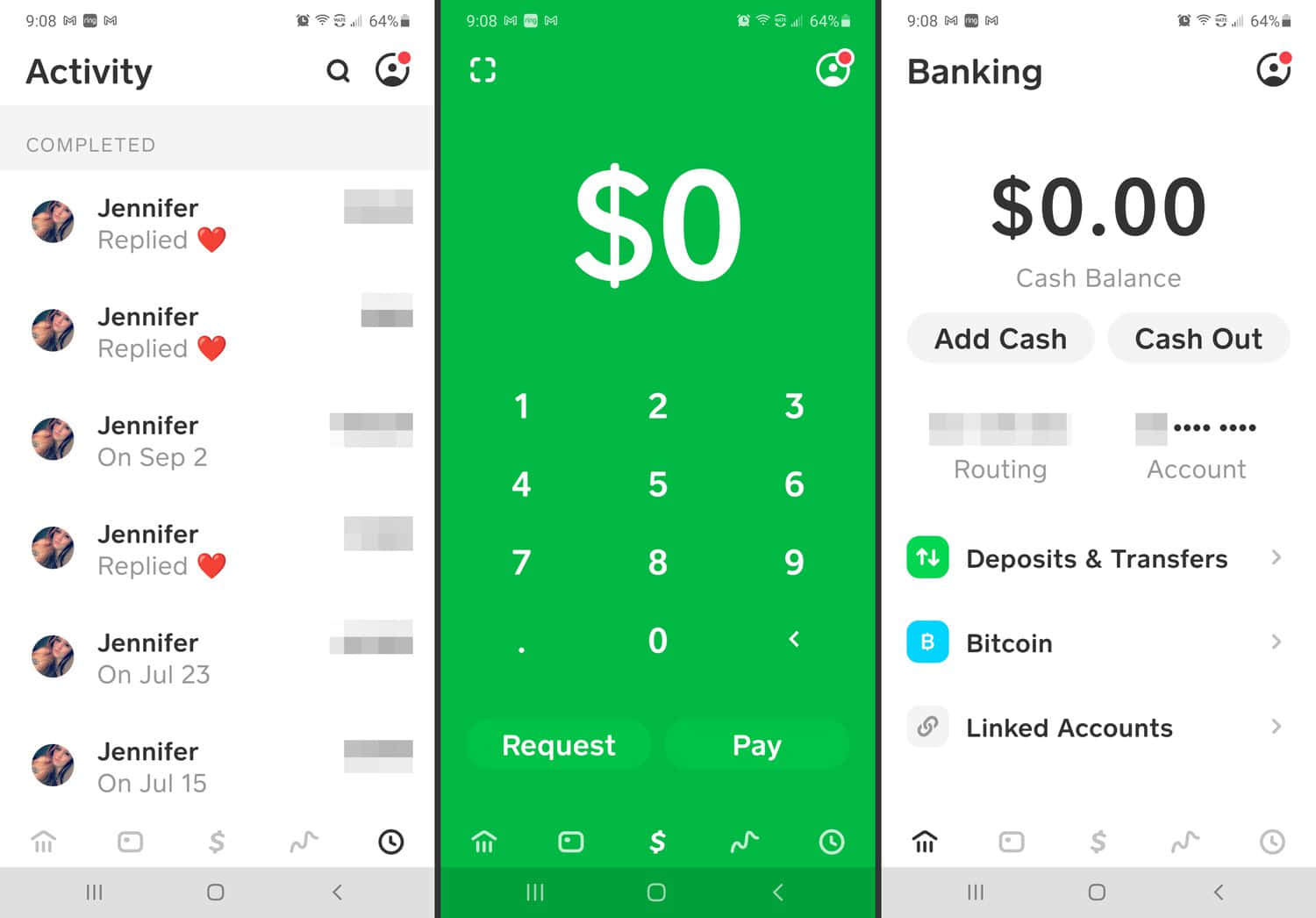

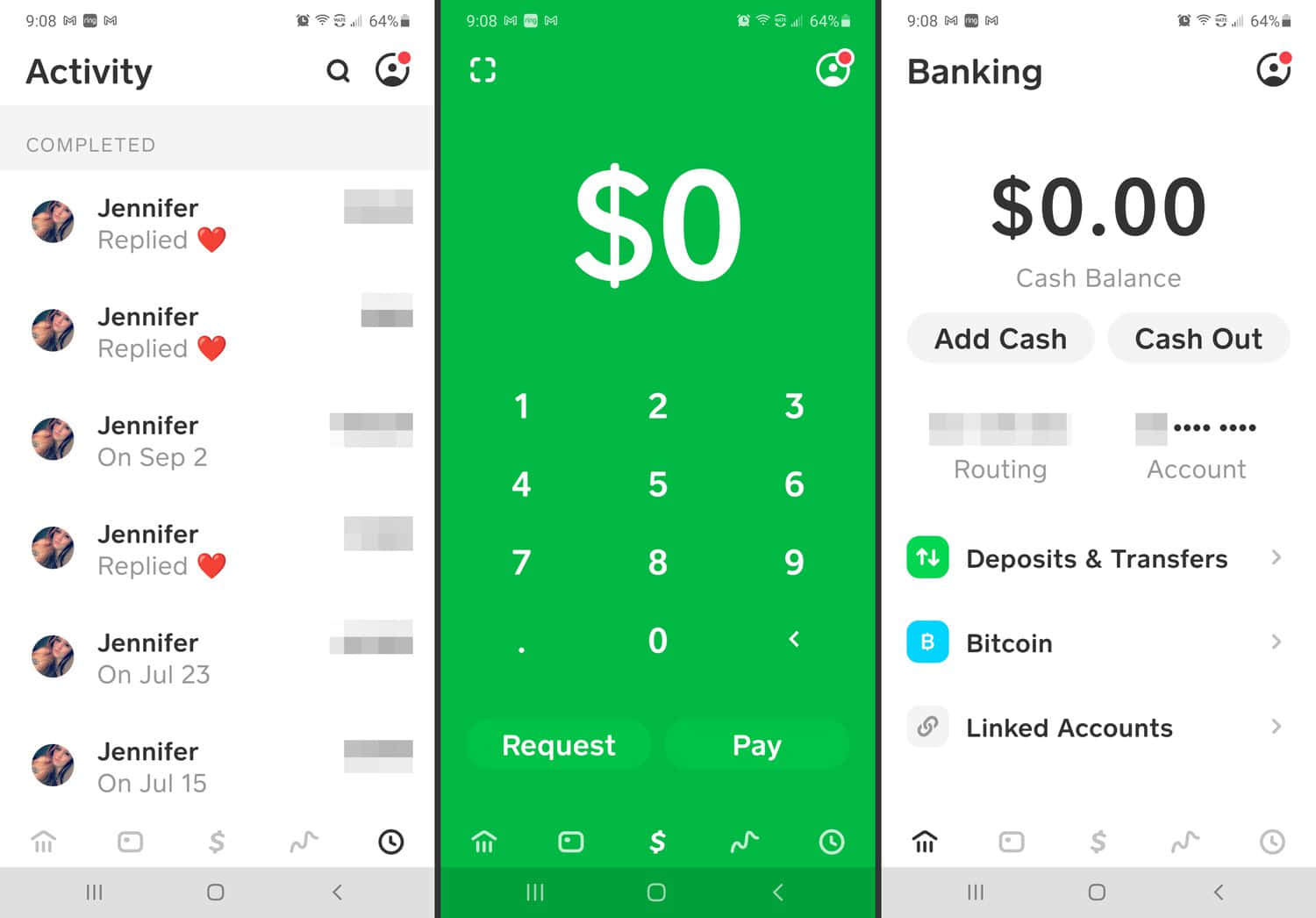

- Any Time obtaining a loan via Money App Borrow, note of which this feature offers an individual together with a immediate mortgage.

- Typically, that will will come along with a $3.99 fee for a $100 funds out there, nevertheless your own 1st Lightning Velocity transfer is free.

- Whenever used sensibly, the Money App funds advance feature can serve as an infrequent crisis finance stream in between credit rating credit card pay cycles.

- When an individual prefer in buy to acquire your own pay transferred in purchase to an exterior account, an individual earned’t have entry in buy to MyPay, plus it’s not necessarily available inside all declares however.

- In Contrast To the other applications right here, PayActiv is a system offered simply by employers in purchase to their particular staff, and this specific software relates in buy to money advances as EWA, which usually appears with consider to Gained Income Entry.

Factors are usually limitless, don’t run out and can’t become transferred to one more user. As Opposed To eligibility-based advancements, points-based improvements are usually repaid more effective days and nights after they’re requested. By Simply using income advance apps responsibly and pairing all of them along with wiser economic strategies, you can avoid dropping in to economic barriers and function in the direction of greater balance more than moment. Even Though asking a family members fellow member or good friend to borrow cash can become hard, they will may possibly end upwards being ready to become able to give a person even more beneficial conditions as compared to a traditional lender or funds advance application. If you locate a person willing in purchase to provide an individual money, repay this promised in purchase to avoid a achievable rift inside your own partnership.

Typically The Latest In Cash

Generally offered by simply tax preparation firms, these varieties of advances provide you early entry to become capable to your current reimbursement. Dependent on whenever an individual request the particular advance, a person may are required to repay attention as higher as 36% APR. Typically The quantity will be centered upon your own estimated refund and is usually typically available when an individual document your current taxes return in add-on to the particular INTERNAL REVENUE SERVICE welcomes it. Ben Luthi is a Salt Pond City-based freelance author that is an expert within a range of private financial plus travel topics. He Or She worked inside banking, auto financing, insurance coverage, in addition to economic preparing prior to getting a a lot of the time article writer. Beem is usually a monetary support device of which assists a person inside unpredicted economic emergencies.

Simply No, right now there usually are simply no additional expenses recharged simply by the money application apart from typically the 5% payment. A Person are usually today departing the particular Brilliant site in addition to coming into a third-party site. Bright provides no manage more than the content, goods or providers offered nor the particular security or privacy regarding details sent to other people by way of their own web site. We All advise that will a person evaluation the particular personal privacy policy regarding the particular web site an individual are getting into. Brilliant would not guarantee or promote the products, information, or recommendations supplied about any sort of third-party web site. A Cash App Borrow financial loan is only a very good deal when an individual have no cheaper alternate borrowing alternatives and you require the cash for a good crisis.

Retain studying in buy to see when your preferred cash advance app performs along with Money Application. Right Now, money advance applications assist us bridge the distance in between paychecks therefore all of us may pay hire, buy groceries, plus maintain typically the lighting upon. Overdraft fees usually are a point regarding the previous any time an individual couple your Funds App bank account in addition to money advance applications. According to be able to typically the Albert site, an individual must hook up a charge cards to a lender account connected to be in a position to 1 exactly where an individual get your income in buy to entry Albert Quick (a cash advance facility). Money advance apps should become aware of your own pay period of time plus salary sum.

Regarding starters, these people aid an individual split totally free from payday lenders plus typically the high-interest payments they will cost. They also aid an individual remain on top associated with your current bills and stay away from the late or overdraft fees evaluating down your own spending budget. At Times, the $100 or $250 reduce about payday advance programs isn’t enough in buy to include all your expenses. Also inside this scenario, a payday mortgage isn’t typically the best way to become able to acquire typically the assist you want. A Person can employ Albert Quick as de facto overdraft security as well. Simply No make a difference how an individual utilize it, there’s no credit score examine — not necessarily actually a soft query — and no concealed fees for use.

- Dependent upon your current transfer method, a person may possibly pay a charge associated with $1.99 – $2.99 per transfer.

- Typical money advance transactions through Dave could take up to 3 enterprise times.

- Advancing up to be able to a thousand bucks requires repeating debris in a MoneyLion Roar Accounts.

- Second, a person want to end upward being in a position to have at least $500 previously inside your current lender account or Existing account to meet the criteria, plus third, a person have to be able to have got $500 inside recurring debris.

Causes Gen Z Feels The Particular Many Economic Anxiety Regarding Any Type Of Era

- Earnin has a spot on our own listing thanks a lot to their Super Rate feature, which often may drop cash directly into your accounts inside minutes (note of which costs may possibly apply).

- We All suggest confirming with typically the resource to validate the particular the majority of up to become able to time info.

- An Individual need to pay a lower $1 month-to-month payment in order to access advancements, yet suggestions are recommended.

- On One Other Hand, comparable to end upward being able to payday loans, a few applications charge higher fees, which usually may possibly translate into sky-high APRs.

- Enhance quantities are usually little, ranging coming from $20 in buy to $500, based upon the particular application plus your own accounts background.

This Specific costs $1 each 30 days, which usually unlocks access to funds advances plus several extra characteristics. Dork requires with respect to ideas, nevertheless these sorts of are optionally available in inclusion to leaving a small idea or no idea won’t effect how much a person can accessibility through ExtraCash. Several choices might end upward being available, yet cash advance apps and private loans usually are often finest if a person need fast funds. Here’s what you require to know concerning exactly how they job plus any time to become able to consider all of them. Once typically the app supplier determines an individual meet the criteria regarding a cash advance, a person may generally request as very much as you want upwards in purchase to your own approved borrowing restrict. Borrowing restrictions are usually low at first nevertheless need to boost together with activity.

Carry Out I Constantly Have Got To Be In A Position To Pay With Regard To Immediate Transfers?

Cash Software doesn’t offer you loans where an individual get cash that will a person could pay again above period. It does offer borrow cash app Pay Above Moment loans with consider to purchases produced via Cash Software. On One Other Hand, this feature doesn’t appear in order to become accessible to end upward being capable to all customers.

Although Present is not really a bank, it partners along with Option Economic Team to provide banking providers. Via its cooperation along with City Business Bank, Present users could link their own company accounts along with Zelle. It’s a bit indirect, nevertheless this particular set up enables Current members to send and receive cash using Zelle. In addition, Current offers a feature similar in buy to a traditional cost savings bank account, which often allows a person to separate your savings into three Savings Pods. Every pod gets upwards to become capable to four.00% bonus money (but together with a lot great print). An Individual may likewise employ Existing in buy to invest, but just in cryptocurrency, plus in buy to get a great interest-free payday advance regarding upwards to $750.

On top of that will, Sawzag consists of handy tools in buy to help a person manage your current funds plus actually a round-up feature in purchase to help a person help save automatically. Money advance apps provide a person access to be in a position to money before your payday, offering a more affordable option to traditional lender overdraft solutions, which usually frequently come together with large costs. Rather regarding relying about high-interest loans, these programs use non-reflex ideas or flat charges as a earnings resource. These Kinds Of apps allow an individual in purchase to get an advance about your current salary, transfer the cash in buy to your current Money Software bank account, and invest all of them as required. Nevertheless does Funds Application in fact job together with well-liked paycheck advance programs just like Brigit, Cleo, Earnin, Klover, and Dave?

Could I Obtain A Financial Loan Upon The Tax Reimbursement Now?

This Specific goes upwards in order to a $40 payment any time you advance $500, which could become pricey in comparison to some other cash advance applications. Klover will be a mobile software that will gives little cash advances within exchange with consider to users’ info of which it stocks with the advertising and marketing plus enterprise lovers. Typically The software offers advances centered on users’ financial institution bank account exercise, but customers could also get surveys, upload invoices in addition to hook up retail store balances in buy to acquire a great advance. When selecting a great software, consider about exactly what characteristics arrange together with your current economic requires. Regardless Of Whether it’s increased advance restrictions, lower costs, or added perks such as early primary build up, finding typically the correct suit may help to make managing your current finances much less difficult. Enable provides speedy cash advancements along with no late charges, although it requires a monthly registration.

Early immediate deposit is a great earlier down payment associated with your own whole salary. It comes nearer to become capable to your pay day compared to a income advance can — usually a couple of enterprise days and nights earlier plus zero even more as compared to four. A paycheck advance will be not really theoretically a financial loan because it doesn’t charge curiosity.