Apps like Beem lead typically the package along with lower charges and immediate funds advancements a person could borrow. Other People just like Chime, Brigit, and Encourage are also good choices this particular 12 months. When a person stay together with the totally free membership, you may acquire advances up to become able to $500. And together with the particular $1 month-to-month administrative payment for a RoarMoney accounts, you could increase your current reduce upward in order to $1,1000. You can likewise briefly boost your Instacash reduce whenever you complete actions within typically the MoneyLion app, get involved inside marketing promotions, or get involved within Peer Improves. One@Work (formerly Even) will be a cost management app that will offers up to end up being in a position to 50% improvements on wages you’ve currently attained through the Instapay function.

Payactiv – Greatest With Consider To Immediate Loans – Gbr Rating: 4Several

Income advancements often bring one-time costs, in addition to some applications charge registration charges to cover the particular cost of extra solutions. Yet you shouldn’t pay interest upon a paycheck advance (and definitely not necessarily on an early direct deposit). It’s a salary advance, or money advance to help protect a person until your next payday. In other words, it’s a approach to acquire paid a small earlier with respect to typically the work you’ve previously performed, generally with out a credit score examine. Just Like several applications on this specific listing, Present doesn’t cost curiosity or require a credit score verify.

What Is Usually The Particular Downside Of Attained Income Access?

This process could take upward in purchase to about three (3) business days in order to complete. It requires 3–6 company days and nights (Mon–Fri, not including federal holidays) to be in a position to safely procedure exchanges initiated in typically the application. Establishing up primary deposit with your own Albert Funds accounts can assist reduce your own VERY SINGLE exchange keep periods to 2–3 enterprise days and nights.

- The money advance sums begin at $20 in order to $70, yet can increase to $250 more than time.

- It is an earned-wage accessibility software that offers users easy manage above their own money.

- But the particular best component will be your own ability in purchase to set your current own due day for cash improvements in add-on to consider out there an additional advance just one day after repaying your current last a single.

- As Compared With To Empower, EarnIn lets an individual borrow upward in purchase to $150 a day in inclusion to up in order to $750 each pay period of time on wages an individual’ve already attained.

It’s not a late charge with consider to absent your funds advance repayment, nonetheless it could end upward being a frustrating demand if your current primary charge payment does not function out. Such As most cash advance programs for Android, your borrow cash app first borrowing restrict will be lower. Most fresh consumers will begin at $25 nevertheless you’ll obtain accessibility to end upwards being capable to between $50 in add-on to $500 right away if MoneyLion picks up repeating debris. Instacash, typically the app’s funds mortgage services, has little inside typically the approach of charges unless of course you want the particular funds quickly, within which often situation you’ll want to pay with regard to the ease. Albert gives a range associated with other monetary services of which could appeal to be capable to all those who else love fintech apps plus cellular convenience.

The APR with typically the most compact charge would be 26.07%, and the particular greatest would be 208.56% APR. In Case an individual wait around 1 in purchase to about three days and nights with regard to typically the money advance, an individual won’t pay additional expenses. Jerry Brownish will be a freelance personal finance author in addition to Licensed Monetary Schooling Instructor℠ (CFEI®) who else life inside Fresh Orleans. This Individual includes a selection of personal financing matters, including credit score, private loans, in inclusion to pupil loans.

MoneyLion offers additional choices to be able to briefly enhance your current limit through actions within just its software or with expert support. Within this specific guide, we’re focusing about money advance programs that supply cash quickly due to the fact all of us understand exactly how crucial speed is usually when you’re inside a good spot. We’ll go walking an individual via the particular best options available so an individual may locate a single that will meets your current requirements without having busting typically the bank. Typically The greatest paycheck advance applications demand practically nothing for regular transactions, which usually usually very clear within just about three company days. These People ought to also charge practically nothing with consider to early on direct deposit, which often generally occurs a couple of business times early but could arrive up in order to four company days and nights earlier within several cases.

- An Individual can move the particular available funds to end upwards being able to your own lender bank account, credit card, or make a funds disengagement.

- Its application songs the particular quantity associated with hours you have worked well plus allows you to end upward being in a position to entry your own cash in accordance to become able to your revenue.

- You may also accessibility your current paycheck up to be able to two times earlier with being approved immediate debris.

- Your lender may demand a person an overdraft payment if you don’t have got adequate funds within your current bank account to pay back the mortgage sum.

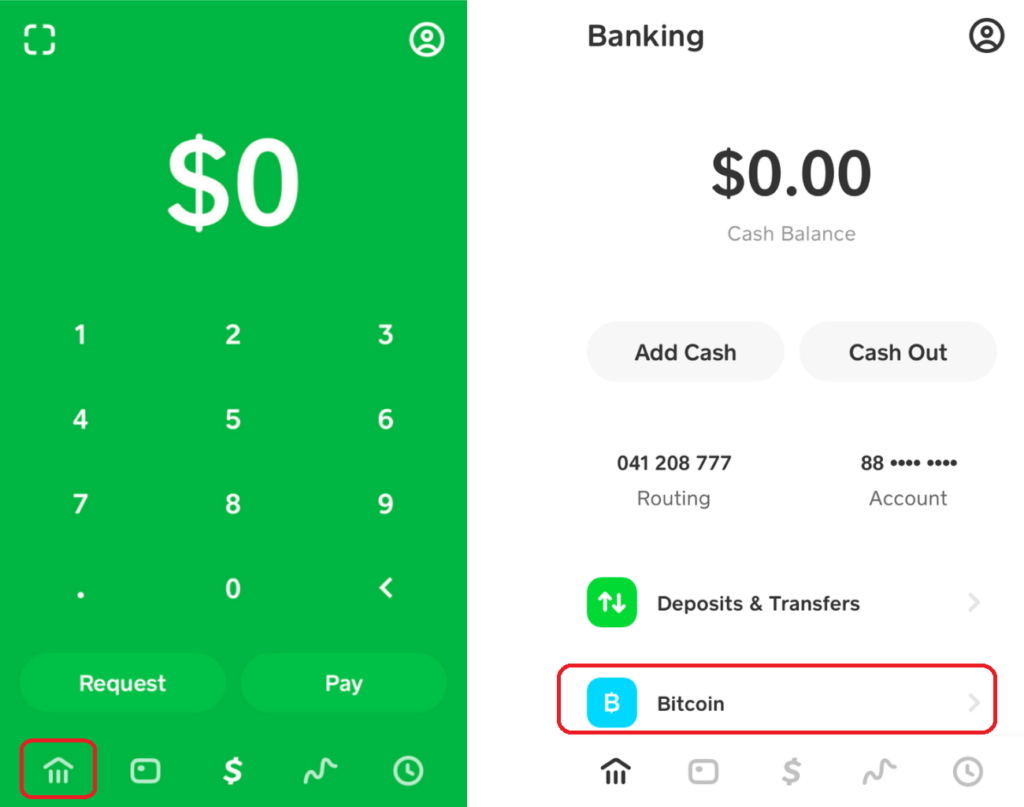

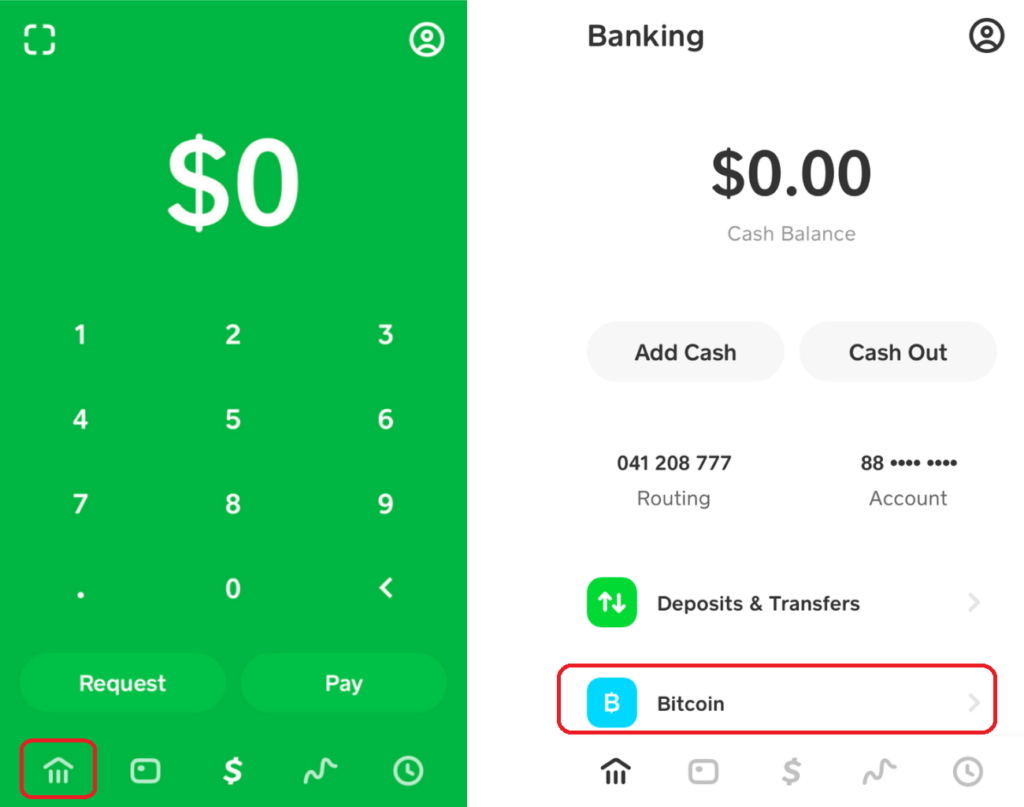

Dave costs $1 each month, which often entitles an individual to be in a position to upward to end upwards being able to a $500 money advance in case an individual use the particular ExtraCash™ alternative, although you are usually entitled in order to borrow up to $5 in buy to $200 in case an individual don’t. To Become In A Position To get started, record in to your current Varo app, select Zelle® under Proceed Cash, and then adhere to typically the prompts in order to sign up. To become entitled in buy to register within Zelle® at Varo, you should possess a being qualified primary deposit within the previous thirty-one days. Once enrollment, you will usually be capable to end up being capable to accessibility Zelle® at Varo. This Particular Fintech system is specifically helpful for employers that have got plenty regarding underbanked or unbanked workers. It provides all of them with a free of charge digital accounts in add-on to debit credit card for dealings.

If your own emergency will be a one-time point plus the particular quantity will be little, consider requesting someone close up to be capable to you if a person can borrow the particular money. Be certain you established clear terms regarding repayment thus presently there are zero misconceptions or hard emotions. Dependent on your own transfer approach, a person may pay a payment of $1.99 – $2.99 each exchange.

#11 – Dailypay: Cash Away Upwards In Buy To 100% Regarding Your Own Gained Wages

These People can trust that the software offers legitimate alternatives without having typically the problem of large costs or complicated terms. Unlike Main Grid, Achievable Financial reports on-time repayments to end upwards being able to all about three credit score bureaus, helping in purchase to develop your current credit score history. Furthermore, Feasible Financial permits customers to expand their transaction day – a user friendly characteristic that will’s not necessarily available together with Main Grid. At Present, competent consumers can borrow little loans through $20 in order to $200. It’s continue to in the particular earlier stages, thus it’s not broadly available simply yet, plus a person’ll most likely need to reside inside a great eligible state, possess good credit rating, plus be an lively user.