There’s zero credit verify in buy to utilize and you’ll take satisfaction in a few associated with typically the cheapest costs associated with any money advance software on this specific cash borrowing app list. Your Own advance will be automatically repaid any time you obtain your subsequent income, nevertheless when you occur in purchase to require a few added moment, Dork won’t cost a person a late fee. Once your advance has been repaid, you’re totally free in order to borrow once more. Money App is a versatile participant inside typically the lending industry, offering a blend of banking abilities plus micro-loans below 1 roof. It holds like a easy option in purchase to traditional borrowing apps along with its unique functions and mortgage offer you. Membership and reduce raises strongly rely upon person monetary scenarios, borrowing historical past, in addition to regular repayment capabilities.

Just How Does Borrowing Through Funds App Impact Our Credit Rating Score?

Funds Application evaluates eligibility case-by-case, getting directly into account numerous elements associated with your current accounts in addition to financial background. Facilitating transaction via a secure system such as Money Application will be a positive, as well. “When it’s in between this specific in addition to proceeding to get a salary advance through a deceptive place, this particular is a better choice,” he claims. This Individual provides that typically the flat five percent payment is usually low for a personal mortgage. The choices to pay back your mortgage earlier within complete or preschedule auto repayments are helpful ways in purchase to minimize the chances of being late, also.

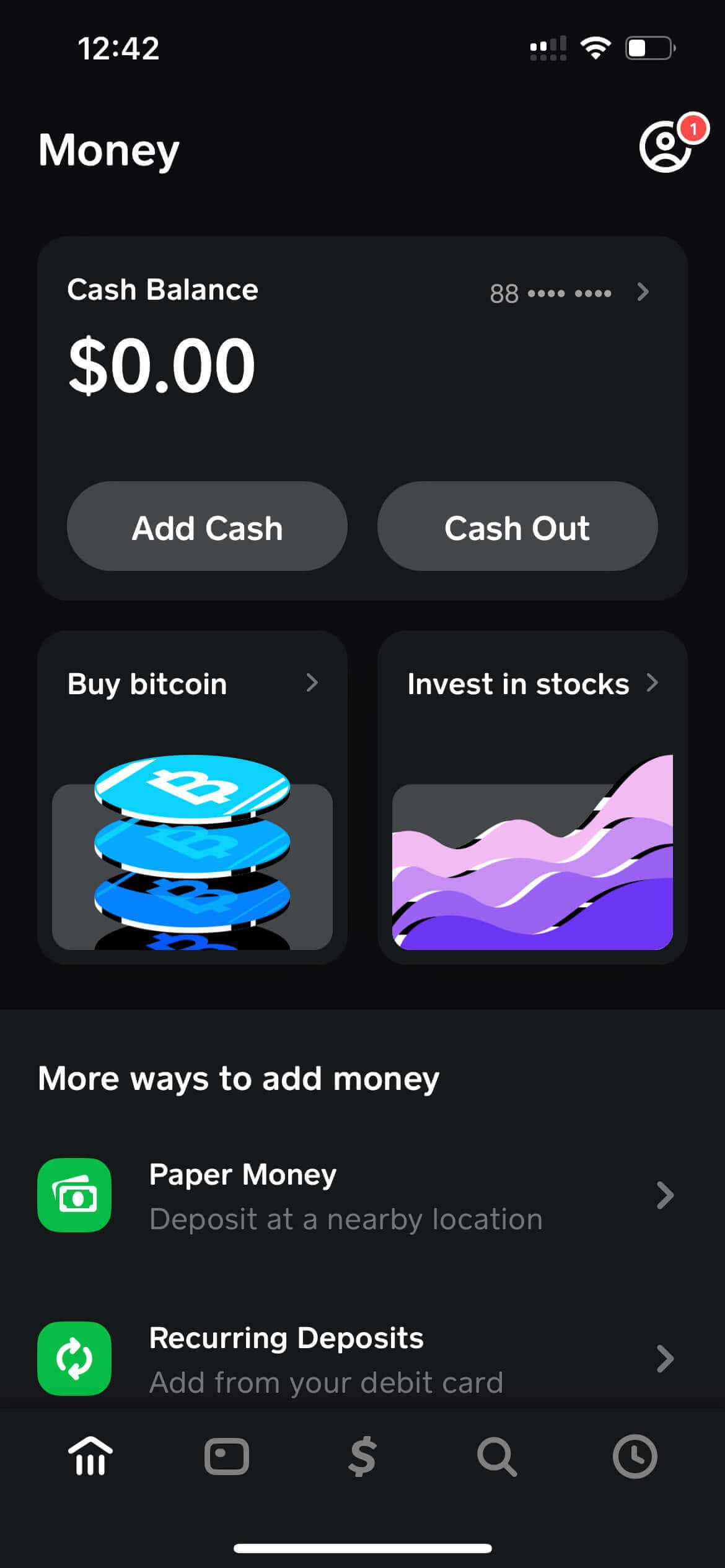

Cash App Financial Loan Software

This Specific site in add-on to CardRatings may obtain a commission from cards issuers. Thoughts, reviews, analyses & suggestions are usually typically the creator’s by yourself plus possess not really already been reviewed, recommended or approved by simply virtually any regarding these entities. Borrowing cash is never enjoyment, specially when an individual locate oneself panicking. We wish this particular post upon how to be in a position to borrow money from Funds Application has helped an individual in purchase to see that will you could borrow money in case you’re desperate.

- Therefore go forward plus open Cash Software Borrow in order to get the particular cash a person need nowadays.

- Cash Application Borrow is usually a feature that will enables eligible customers to be able to take out tiny loans directly via the software.

- It can be a possibility of which the Funds app might have got some insects or specialized mistakes leading to the particular borrow function in buy to not necessarily job.

- Nevertheless, if an individual have got empowered this particular choice in addition to want in order to make use of it, you should understand exactly how to do it appropriately.

Pros In Add-on To Cons Of Borrowing From Cash App

- When you do not do it, an individual will become charged a one.25% charge regarding each 7 days that will moves without having having to pay.

- However, the factors outlined previously mentioned usually are still likely in buy to end upward being inside play in spite of a good lively account.

- Whilst many money advance apps may appear comparable, it’s essential to end up being in a position to differentiate the Cash App’s borrow characteristic.

Funds Application is a person-to-person payment app that allows people in purchase to deliver in addition to obtain money to and coming from 1 an additional quickly. The Particular app had been introduced in 2013 simply by Block, Inc. (formerly Sq, Inc.) to contend with additional repayment applications like Venmo and PayPal plus had been initially referred to as Rectangular Funds. By next these kinds of methods, a person could easily accessibility Cash Software Borrow when an individual fulfill the membership specifications. Money App provides loans in between $20 and $200, nevertheless not necessarily all customers are usually qualified regarding typically the same loans.

While it could become frustrating in order to wait for it to end up being able to get more widely available, a person may make use of the ideas in purchase to meet the criteria regarding Borrow more quickly or try out a single regarding the alternative ways in order to acquire money. You’ll get a little amount—somewhere between $20 and $850—for a fixed term regarding several weeks. The easiest way to obtain money through Cash Software is usually by seeking your own friends in order to send a person several. So the particular option could appear plus and then fade randomly—without any sort of justification supplied. Payday loans demand from $10 in purchase to $30 per each $100 you get out there.

Exactly How To Consider Away A Loan With Money Application: A Good Specialist Weighs Advantages In Add-on To Downsides

But it’s important in buy to understand just how it functions in addition to exactly what to view away for. An Individual could pay back your mortgage through typically the money an individual receive within just the Cash Software (10% regarding each deposit). Additionally, you may also create obligations by hand every 7 days or pay in complete at once. You’ll require to be capable to pay using typically the money a person down payment within just the particular Money App. Furthermore, Funds Software will take typically the sum coming from your Cash Application stability automatically if an individual don’t pay by the particular deadline day. Understanding just how to borrow cash about Cash Software is usually great in case a person need to help to make tiny, initial loans.

(You’ll also earn funds for simply completing your current profile!) A Person could earn money nowadays in add-on to take away your earnings via PayPal when you’ve attained $10. An Individual could make above $100/month along with KashKick – in addition to an individual don’t require to devote a dime or consider away your own credit score card to carry out it. Typically The fast authorization periods in inclusion to versatile borrowing limits regarding many cash advance applications can assist decrease a few regarding the particular stress.

- Implementing regarding a money advance with Funds Software Credit Card will be easy and straightforward.

- Your Current eligibility is usually dependent about your own account exercise plus area, thus the particular borrow option may possibly not really be accessible to end upward being capable to you at this specific moment.

- Membership And Enrollment plus limit increases firmly count on person monetary scenarios, borrowing background, in inclusion to timely repayment capabilities.

- When you’re nevertheless having problems deciding when this specific is usually typically the correct choice regarding a person, weigh typically the advantages plus cons before an individual help to make a move.

- Borrowing funds from Funds Application is uncomplicated, but making use of it smartly demands method.

Repayment Construction And Curiosity Costs

When you borrow cash coming from Cash Software, you will have got to be in a position to pay an extra flat fee of 5%. For illustration, borrowing $200 means you must repay the financial loan along with a great extra $10. By Simply understanding these varieties of repayment phrases, it becomes less difficult to be able to manage repayments in inclusion to keep organized throughout typically the process. This helps ensure of which borrowers have greater handle more than their particular finances although using cash programs credit score cards for a funds advance. Today let’s consider a better appear at security plus scams security measures supplied by Money App Credit Rating Cards.